2023 Tax Brackets and Standard Deductions

2023 Tax Brackets and Standard Deductions

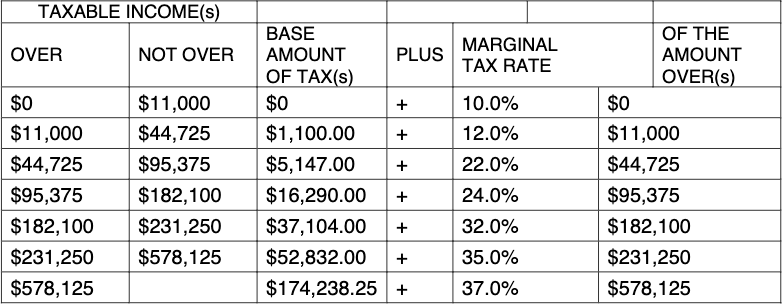

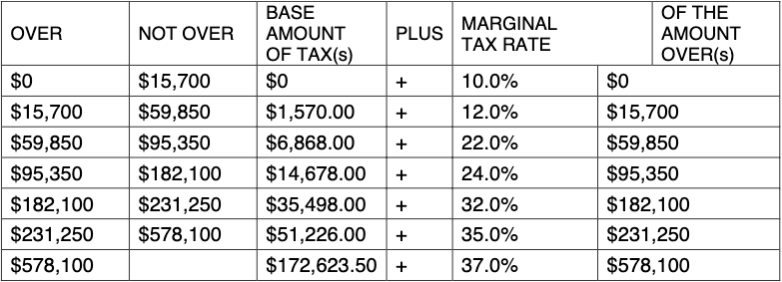

Single

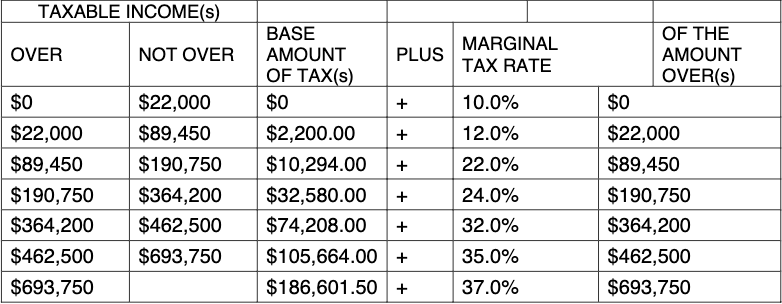

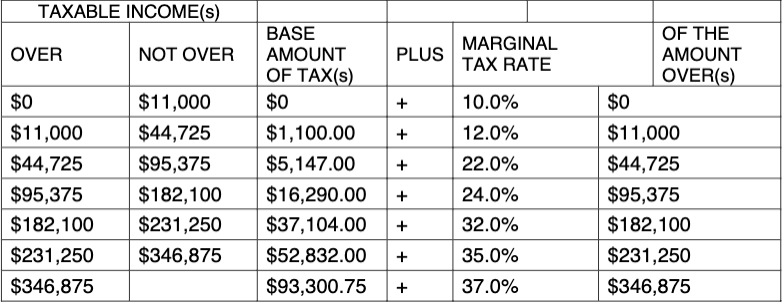

Married Filing Jointly and Surviving Spouses

Head of Household

Married Filing Separately

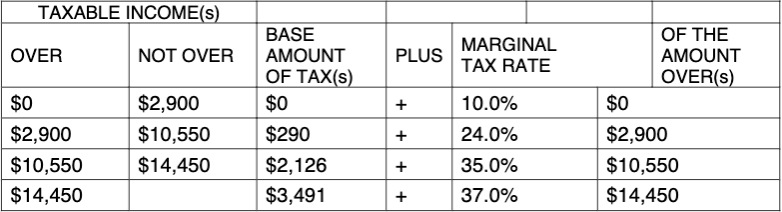

Trusts and Estates

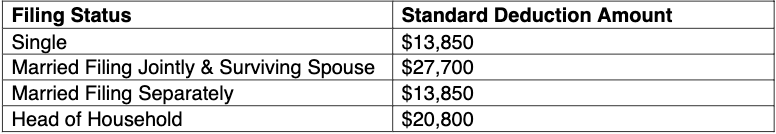

2023 Standard Deductions

- Additional Standard amount for age 65+ or blind for Married Filing Jointly, per taxpayer: $1,500

- Additional Standard amount for age 65+ or blind for all others statuses: $1,850

- The standard deduction for an individual who may be claimed as a dependent by another taxpayer is the greater of either $1,250 or the individuals earned income plus $400 that does not exceed the regular standard deduction of a single filer.